By: Wim Grommen

Every production phase or civilization or other human invention goes through a so called transformation process. Transitions are social transformation processes that cover at least one generation (= 25 years). In this article I will use one such transition to demonstrate the position of our present civilization and its possible effect on stock exchange rates.

When we consider the characteristics of the phases of a social transformation we may find ourselves at the end of what might be called the third industrial revolution. Transitions are social transformation processes that cover at least one generation (= 25 years). A transition has the following characteristics:

- it involves a structural change of civilization or a complex subsystem of our civilization

- it shows technological, economical, ecological, socio cultural and institutional changes at different levels that influence and enhance each other

- it is the result of slow changes (changes in supplies) and fast dynamics (flows)

Four transition phases

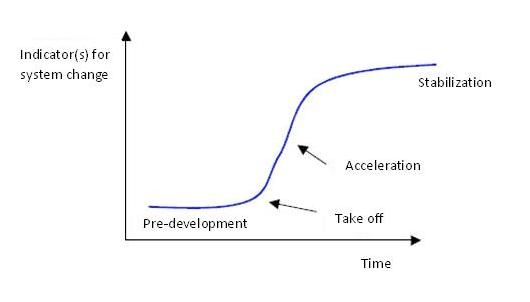

In general transitions can be seen to go through the S curve and we can distinguish four phases (see fig. 1):

- a pre development phase of a dynamic balance in which the present status does not visibly change

- a take off phase in which the process of change starts because of changes in the system

- an acceleration phase in which visible structural changes take place through an accumulation of socio cultural, economical, ecological and institutional changes influencing each other; in this phase we see collective learning processes, diffusion and processes of embedding

- a stabilization phase in which the speed of sociological change slows down and a new dynamic balance is achieved through learning

A product life cycle also goes through an S curve. In that case there is a fifth phase:

- the degeneration phase in which cost rises because of over capacity and the producer will finally withdraw from the market.

The S curve of a transition

Figure 1: Four phases in a transition best visualized by means of an S curve.

Examples of historical transitions are the demographical transition and the transition from coal to natural gas which caused transition in the use of energy. A transition process is not fixed from the start because during the transition processes will adapt to the new situation. A transition is not dogmatic.

Three drastic transitions

When we go back into the past three transitions took place with far-reaching effects.

- The first industrial revolution

The first industrial revolution lasted from around 1780 tot 1850. It was characterized by a transition from small scale handwork to mechanized production in factories. The great catalyst in the process was the steam engine which also caused a revolution in transport as it was used in railways and shipping. The first industrial revolution was centered around the cotton industry. Because steam engines were made of iron and ran on coal, both coal mining and iron industry also came to bloom.

This revolution ended in 1845 when Friedrich Engels, son of a German textile baron, described the living conditions of the English working class in “The condition of the working class in England“. The result of this revolution: an immense gap between rich and poor.

- The second industrial revolution

The second industrial revolution started around 1870 and ended around 1930. It was characterized by ongoing mechanization because of the introduction of the conveyer belt (? assembly line), the replacement of iron by steel and the development of the chemical industry. Furthermore coal and water were replaced by oil and electricity and the internal combustion engine was developed. Whereas the first industrial revolution was started through (chance) inventions by amateurs, companies invested a lot of money in professional research during the second revolution, looking for new products and production methods. In search of finances small companies merged into large scale enterprises which were headed by professional managers and shares were put on the market. These developments caused the transition from the traditional family business to Limited Liability companies and multinationals.

After the roaring twenties the revolution ended with the stock exchange crash of 1929. The consequences were disastrous culminating in the second world war.

- The third industrial revolution

The third industrial revolution started around 1940 and is nearing its end. The United States and Japan played a leading role in the development of computers. During the second world war great efforts were made to apply computer technology to military purposes. After the war the American space program increased the number of applications. Japan specialized in the use of computers for industrial purposes such as the robot. By now the computer and communication technology take up an irreplaceable role in all parts of the world. The acceleration phase of the third industrial revolution started around 1980 with the introduction of the micro processor. The third industrial revolution has clearly reached the saturation and degeneration phase. This phase is characterized by a saturated market and growing competition. Only the strongest companies can handle the competition or buy up their competitors (think of the takeovers by Oracle and Microsoft in the past few years). Essentially there is relatively little new technology in the IT world despite what the marketing machines from America would have us believe.

We can safely state that in some 25 years an industrial revolution has effectively dismantled a welfare state; the excesses of our society are visible everywhere (excessive salaries for executives, bookkeeping fraud, fraud with shares). There will be consequences for the stock exchanges. It is a matter of time but unavoidable.

Dow Jones exchange rates

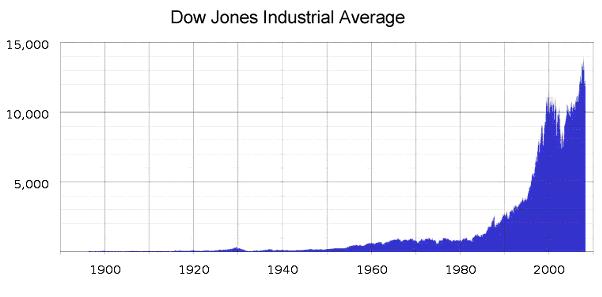

Figure 2: Exchange rates of Dow Jones during the latest two industrial revolutions. During the last few years the rate increases have accelerated enormously.

Triggers

What events could end the latest industrial revolution and cause another stock market crash?

1 Shortage of raw materials

The shortage of raw materials or water which enlarge the chances of war between groups of people? The changes in the climate taking place on mother earth which force mankind into a different kind of behavior? Everyone is convinced that we can not go on the way we are going now. The present course will eventually lead to a gradual decrease of economic activity which will make the indexes drop slowly. This transition will stretch over a longer period.

2 Natural disasters

Another phenomenon that can cause a stock market crash is formed by natural disasters. This scenario is not linked tot the present industrial revolution. History has taught us that earthquakes and tsunamis can make complete cultures suddenly disappear (like Atlantis). If this happens to an economic super power like Japan or the US the consequences for the stock market indexes will be obvious.

3 Man made changes

Or will human behavior itself, as so often in history, be the cause of the end of the third industrial revolution? What might happen when suddenly a counsel of wise men and women appears that wants to reform to a society of wisdom and convince the population that such a reform is much better for a lasting society?

The political leaders of our country have continued the privatization process over the past years. According to the politicians of our country more competition will lead to lower cost for our citizens. However, people have noticed that the cost of primary services has shown an enormous increase over the past few years and have lost their faith in politics. The government policies clash with the policy of the captains of industry who want an increase of scale to lower their cost. We can conclude that the process of privatization of elementary services in our society has failed completely.

Suppose this counsel of wise people were to start a sparkling campaign among the people called “From knowledge based economy to wisdom society”.

Having asked for an offer for all 17 million citizens, the counsel calls on the people to change to the same health care supplier and the same energy supplier. The effect of this call for an increase in scale will be: less housing cost, less personnel cost, less ict cost, less marketing cost, less accountancy cost. This will result in lower cost for health care and energy supplies for Dutch citizens.

After three years the counsel will call on the citizens to change to the same grocery store, the same bank and the same fuel supplier.

The effect of this call for scale increase will again be: less housing cost, less (outrageous) personnel cost, less ict cost, less marketing cost, less accountancy cost. The cost of bank and fuel cost for Dutch citizens will also decrease dramatically.

The effects of this call for increase in scale for the society as a whole will be enormous. There will be less work for the same number of people.

According to the counsel of the wise there will be immense advantages to this increase in scale:

- After retraining and redistribution of work more people will be available for education, health care, security and welfare so that our welfare state, which has been dismantled in 25 years, can slowly be restored.

- The citizens of the Netherlands will have more spare time

- Society will be less stressed, which will lower the cost of mental health care (and probably also lower the amount of senseless violence).

- Fewer people will be on the roads on their way to work thus automatically solving traffic problems and ending the need for new roads

- The Dutch citizens will have more time to teach their children the social values that everybody thinks are so important

- The Dutch citizens will have more time to make the integration process a success

- There will be less pressure on the environment, improving the durability of society.

“Every advantage got its disadvantage” is a saying by a well-known Dutchman. This increase in scale will cause an immense implosion of economic activity in a society. The effects on stock market indexes will be obvious.

Conclusion

According to the Mayan calendar described in “The Mayan calendar and the transformation of consciousness” by Carl Johan Calleman we live in a very special time. The Mayan calendar is a metaphysical map of the evolution of consciousness and records how spiritual time flows. The calendar presents nine cosmic cycles that represent nine phases of consciousness. In 2011 these nine cycles that the earth has gone through will end simultaneously. The book reveals that the Mayan calendar is a spiritual and prophetic device that enables a greater understanding of the evolution of consciousness driving human history. It predicts a phase of radical changes for the world and humanity. After the failure of communism in 1989 the calendar also predicts the imminent collapse of capitalism. The first hairline cracks in this system are already beginning to show.

This article was published in “Technische en Kwantitatieve Analyse van Beleggers Belangen” in November 2007.

Sources used

Transities & transitiemanagement, casus van een emissiearme energievoorziening, Prof. dr. ir. Jan Rotmans) , Geschiedenis Werkplaatssite by Wolters-Noordhoff.

Wim Grommen worked as a mathematics and physics teacher. He has been an ict trainer in for 25 years. At the moment he is a trainer for Transfer Solutions, an ict company specialized in services for Oracle databases and applications and Java technology. For the past few years he has been studying social transformation processes and the S-curve.