By: Cliff Kincaid

Accuracy in Media

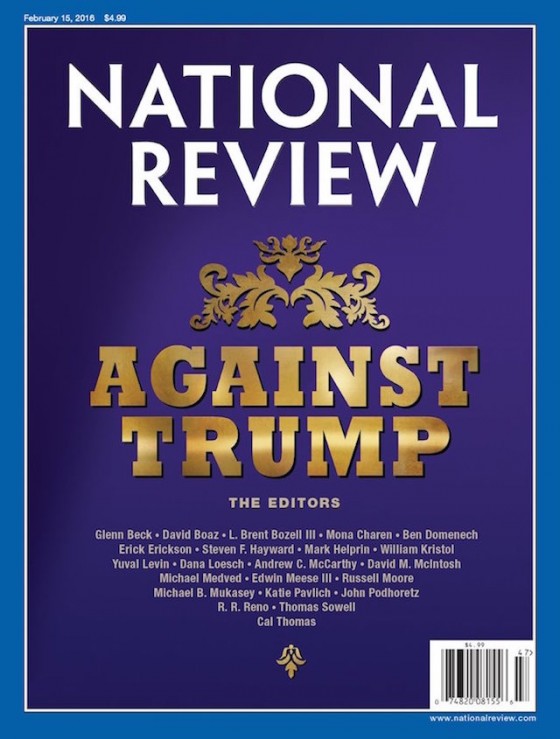

On the eve of the Iowa caucuses, a controversy has broken out over whether the conservative magazine National Review is a non-profit entity that violated tax laws by attacking Republican presidential candidate Donald Trump as a fake conservative.

A libertarian commentator is claiming that National Review is a non-profit entity that violated tax laws with its “Against Trump” editorial and collection of commentaries from various conservative personalities. But Jack Fowler, publisher of the magazine, says the claims are based on misinformation about the magazine’s tax status. He tells AIM that National Review is not tax-exempt itself, but is owned by a tax-exempt institute. Indeed, the “donate” page for the on-line version of the magazine does not promise tax-deductibility for contributions.

At the website of Chronicles, a competing conservative publication, Justin Raimondo cited claims that National Review is tax-exempt and said, “This anti-Trump issue of National Review is, in effect, a campaign pamphlet directed against a political candidate—indeed, the cover proclaims ‘Against Trump’—and, as such, is in clear violation of IRS statutes regulating nonprofit organizations.”

He cited a story last year from Politico, which reported that National Review was becoming a nonprofit organization, which would make it exempt from federal taxes. The article also noted that it was merging with the nonprofit National Review Institute (NRI), its sister organization. The apparent purpose of the change was to save money for the magazine and encourage donations.

Also citing Politico, Eric Wemple of The Washington Post said, “The magazine last year became a nonprofit organization so that its contributors could enjoy the tax benefits of their generosity.”

If true, the publication of the material attacking Trump would represent a potential violation of the IRS tax code. An exemption from federal taxes means the organization is prohibited from endorsing or opposing candidates for office.

On the left side of the political spectrum, The Nation magazine has endorsed Sen. Bernie Sanders (I-VT), but it remains separate from The Nation Institute, which is non-profit and tax exempt.

The anti-Trump editorial in National Review, signed by the editors, said Trump was “not deserving of conservative support in the caucuses and primaries,” in part because his political opinions “have wobbled all over the lot.” Several conservatives wrote their own articles attacking Trump.

Fowler said National Review is the same entity that it has been for 60 years, since it was founded by William F. Buckley, Jr. The difference is that “We are now owned by the National Review Institute,” he said. Fowler said that the two entities have separate boards and separate sources of revenue.

The National Review Institute’s 2015 year-end newsletter called the change “a major institutional transformation.” It said, “On August 1, 2015, NRI and National Review underwent a significant reorganization: the magazine and website—corporately, National Review, Inc.—became a wholly owned subsidiary of National Review Institute. This is good—very good—not only for NRI, but also for National Review. This organizational transition will allow NR to remain consequential for decades to come and allow it to do what it does best—publish hard-hitting, thoughtful, and witty pieces from today’s best conservative writers.”

Some of the confusion may stem from what is said elsewhere on the website of the National Review Institute. It says the magazine and the institute “joined forces so that the entire National Review enterprise,” including the magazine’s editorial activities and the institute’s educational programs, could have a greater impact. Itadds, “All aspects of the National Review family will be combined within one entity.”

Based on this part of the website, which is devoted to opportunities for jobs at the institute, it would appear that the magazine and the institute became one and the same, apparently some time last year.

But that’s not the case, Fowler said. Instead, it appears one is now a subsidiary of the other.

It was not immediately clear how National Review could legally become part of a non-profit, which is supposed to be “educational,” while pursuing partisan and political activities apart from its parent company.

In any case, the overlap between the two entities is significant. The National Review Institute says it “supports” National Review writers, such as the “widely popular and increasingly influential” Charles C.W. Cooke. It was Cooke who made an appearance on MSNBC to lead the National Review charge against Trump, calling the billionaire businessman a “con-man” and “charlatan.”

Commenting on Sarah Palin’s “rotten endorsement” of Trump, Cooke suggested it was all about staying in the spotlight and making money. He declared, “That Palin and Trump are together at last is no accident of ideology or timing; rather, it is the inevitable and rational confluence of two ghastly cults of personality—a fat-cutting, cash-saving merger that will serve to increase overall market share.”

It appears that Cooke is a British citizen who can’t even vote for or against Trump. His personal website says that “He emigrated to the United States in 2011 and lives in Connecticut with his wife, and their dog, a black labrador named Oakley.” He asks for personal donations for his work through PayPal.

While National Review argued that Trump had “wobbled” on conservative matters, Cooke has emerged as a major supporter of same-sex marriage, a position opposed by most conservatives. He argues in his book, The Conservatarian Manifesto, in favor of homosexual marriage, saying, “there is more to be gained by including gays in the institution [of marriage] than by keeping them out.”

For his part, Trump called National Review a failing publication and accused some of those writing articles against him of having asked for his money or wanting him to go on their radio and TV shows. When he refused, he said, they turned against him.