By: Terresa Monroe-Hamilton

I am a Constitutional Conservative. Always have been. But when it comes to taxes, I go even further. I am a Libertarian. I know that most Americans proclaim that they don’t mind paying their fair share of taxes. Well I do – I believe you should be able to keep what you earn and decide how to spend it. I believe the federally mandated income tax is unconstitutional, just as Grover Cleveland did. Federal Income Tax and the Sixteenth Amendment were brought to us by a Progressive favorite, the 27th President of the United States, William Howard Taft. Taft was President Theordore Roosevelt’s chosen successor. Teddy’s Progressives moved forward with a big ole stick indeed.

I can hear people screaming that I am un-American already. You sure about that? What I believe is that expenditures that we now cover with taxes should be handled privately and independently. Give the handling of these expenditures back to the states, the cities, the neighborhoods – the individuals that are now enslaved tax payers. Paying for things like schools and roads should never have been taken up by the federal government. All that does is create waste, corruption and red tape. As our founders envisioned, the majority of items that need to be dealt with from a government level having to do with spending should be done within the purview of the individual states. Less federal government, more local governmental control and more individual responsibility should be the goal.

Now, having said that and realizing that doing as I have proposed has about as much chance as a snowball in hell of coming into being, two viable options are either a flat tax or a national sales tax. Either would radically simplify the tax code. Both would ironically reduce taxation while collecting more money. My choice is to support the Fair Tax and you should too. If you want to read up on it, you can purchase a great book on it at Amazon.com by Neal Boortz and John Linder – The FairTax Book. Abolish the IRS – adopt the Fair Tax.

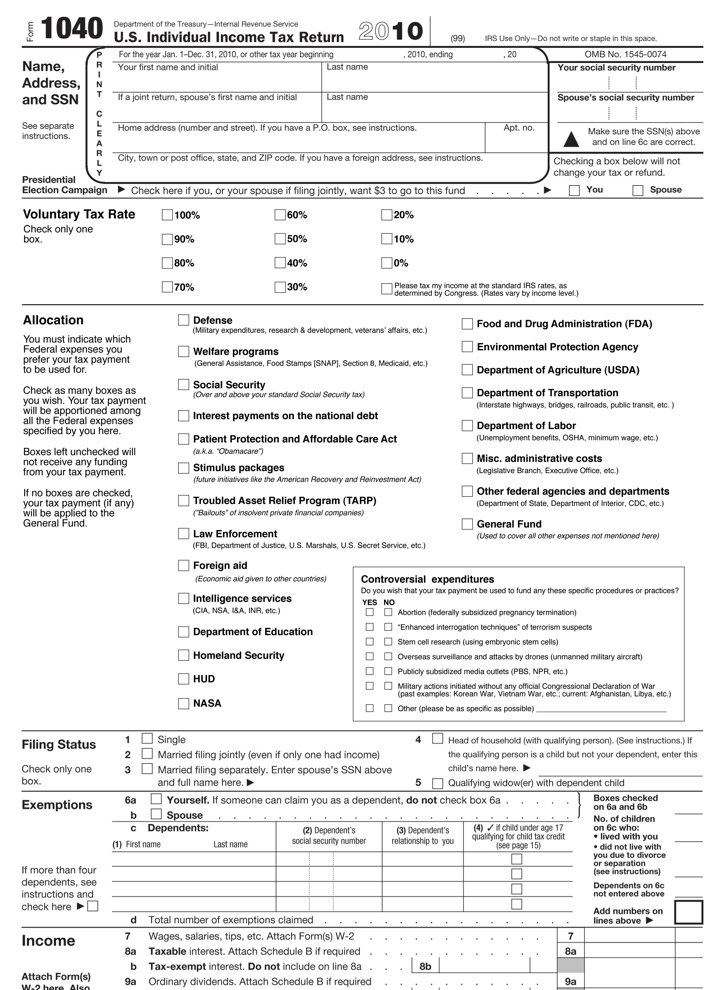

Now, on to a fascinating view on modifying the federal income tax put forth by Zombie at Pajamas Media – Voluntary Tax Rates and Personalized Earmarks: How to Solve the Debate over Taxes.

The proposal lets people ‘choose’ their tax rate and also to ‘choose’ what to spend their taxes on. I have to admit it is genius and makes me smile.

Just a couple of itsy-bitsy points:

- While it is true that Tea Party Conservatives would pay as little tax as possible, I definitely would not assume that Liberals would pay more. They also would most likely pay as little as possible. Taxes are universally hated and in this economy EVERYONE is looking to get back as much of their money as they can to survive.

- It would be great to have a say on where your taxes are spent, but it would turn into a highly corrupted shell game in short order. There is so much graft and corruption in the federal government, your money still wouldn’t get where you want it to be and I doubt you will ever get a chance to review those books.

If it were an ideal world where everyone kept their word and had personal responsibility, Zombie’s theory might stand a chance. In a Romanesque decline in America, not so much. ‘Fairness’ is a fluid political construct any more. You should read Zombie’s piece and noodle it for yourselves. Then come up with your own ideas. Maybe Zombie’s idea will spark the idea(s) that will revolutionize our tax code finally. Then I could say I knew Zombie when… 🙂

Below you will find the proposed new and improved 1040: